Building Donor Trust: 5 Tips for Ethical Fundraising

For nonprofits like yours, cultivating relationships with donors is critical for fundraising success. When supporters feel like they’re a valuable part of furthering your mission and have a positive experience contributing, they’re more likely to become long-term donors to your nonprofit.

The foundation of a strong donor relationship is trust in your organization. To continue participating in your fundraising initiatives, supporters need to know that their donations are used effectively to support your mission-critical programs and projects.

This is where ethical fundraising practices come into play. To help you get started, here are five tips to boost donors’ confidence in your nonprofit by fundraising ethically:

Register for Charitable Solicitations

Tell Stories With Care

Prioritize Donor Data Privacy

Be Transparent About Your Organization’s Financial Status

Promptly Acknowledge and Thank Donors

Ethical fundraising isn’t just important for engaging supporters and increasing donations. Your organization is also subject to several nonprofit-specific regulations for reporting and registering its activities, and the tips in this guide will help you maintain compliance with those rules. Let’s get started!

1. Register for Charitable Solicitations

Before your nonprofit can start asking supporters for donations, you’ll likely need to complete the process of charitable solicitations registration at the state level. Registering not only helps avoid legal consequences—it also solidifies your organization’s reputation as a legitimate nonprofit that will use the donations you solicit to make a difference in your community.

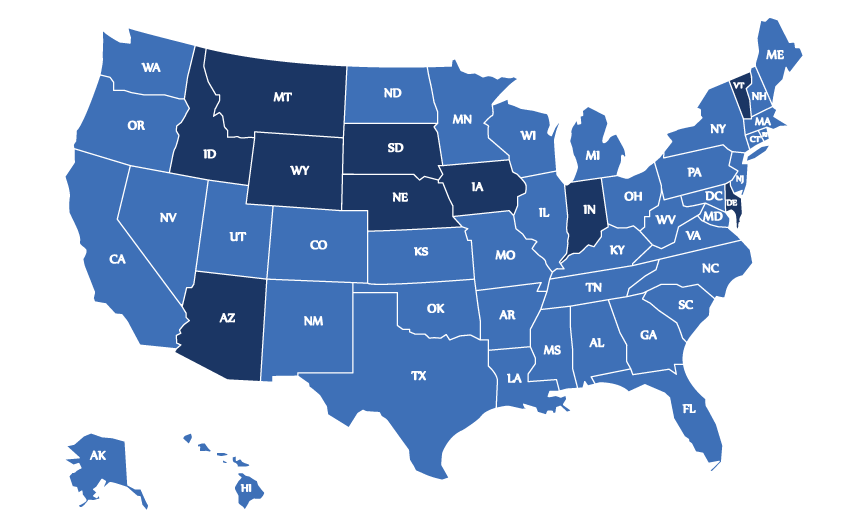

Your nonprofit will need to register for charitable solicitations in any and all states you plan to fundraise in where registration is required. According to Foundation Group, 40 of the 50 U.S. states have a registration requirement as of 2023, as shown on the map below:

This map shows states where charitable solicitations registration is required in light blue and states where it isn’t in dark blue.

Nearly all of your nonprofit’s fundraising activities fall under the requirements for charitable solicitations registration, from hosting events to collecting online donations to launching direct mail campaigns. Make sure your organization is registered before soliciting contributions in any state and that you renew your registrations whenever necessary.

2. Tell Stories With Care

In both print and digital fundraising asks, storytelling is a popular strategy among nonprofits. True stories engage donors’ emotions more than facts alone, allowing them to connect more deeply to your cause and inspiring them to contribute.

However, there are some ethical considerations associated with nonprofit storytelling that you should be aware of before you dive in. For instance, you should make sure to:

Get permission to use real people’s names and photos. Most of your nonprofit’s stories will either focus on a longtime supporter or a beneficiary of your services. Before using their names or photos in your fundraising asks, request permission from your subjects in writing. Also, honor these individuals’ preferences if they’d rather you not show their faces or refer to them using a pseudonym.

Tell the story as it happened. It can be tempting to exaggerate the details of a story to bolster your nonprofit’s image and persuade more supporters to donate. But because your stories concern real people, it’s important to be honest and authentic in telling them.

Ground your storytelling in data. Backing up your stories with concrete facts helps demonstrate their authenticity in addition to making them more compelling. For example, an animal shelter might tell a story about a cat they rescued and mention the fact that this cat was just one of the 200 animals adopted from their organization last year. Like with the details of your story, make sure not to manipulate or exaggerate your data.

Striking the right balance between truthfulness and emotional appeal in your storytelling will not only inspire donors to give but also make them feel good about doing so.

3. Prioritize Donor Data Privacy

Donor data is an important resource for understanding who your supporters are and how they engage with your nonprofit. However, the idea of your organization collecting and storing sensitive information sometimes causes privacy concerns to arise among donors.

To help alleviate these concerns, demonstrate to your donors that data privacy is a priority for your nonprofit. You can accomplish this by:

Creating a resource that explains the various ways your nonprofit uses donor data.

Allowing donors to opt out of having their data collected by your organization.

Following data security best practices like encryption and two-factor authentication to reduce the risk of database breaches that expose donors’ personal information.

Additionally, train your organization’s staff in proper data management. This way, you’ll ensure that your entire team is equipped to follow through on your promise to protect donors’ privacy.

4. Be Transparent About Your Organization’s Financial Status

Although donors often value privacy when it comes to their own data, many of them also want to see proof that your nonprofit is effectively managing its finances. After all, most of your organization’s funding likely comes from their hard-earned monetary gifts, so they appreciate when your nonprofit is transparent about how those funds are being used.

Here are some ways to increase transparency with donors around your nonprofit’s finances:

Make it known that your Form 990 is public. Once your organization files its annual Form 990 with the IRS, you're required to make it publicly available. The IRS will publish it online themselves, usually within three months to a year of its filing. Consider linking to your Form 990 on your nonprofit's website so that any donors who want to see it can locate it easily.

Include financial information in your annual report. Try to make this information accessible to donors with various levels of financial knowledge. For instance, you might include a few charts and graphs with brief descriptions in the body of the report so readers get the gist of your organization’s financial situation at a glance. Then, you can attach more detailed statements as appendices for donors who are interested in learning more.

Communicate with donors if your 501(c)(3) status is revoked. This demonstrates that your organization is willing to admit to its mistakes and is actively working to fix them. Additionally, you’ll help your donors avoid the mistake of claiming a tax deduction for a gift to an organization that is no longer tax-exempt.

Being externally accountable to your nonprofit’s donors in these ways can also help improve your internal financial management practices. If you know you’ll need to report on your organization’s status, it’s often a good motivator to keep accurate records, file your Form 990 on time, and create useful reports of your financial data.

5. Promptly Acknowledge and Thank Donors

Your nonprofit’s ethical fundraising practices don’t end when a supporter donates. According to eCardWidget’s donor recognition guide, acknowledging your donors’ contributions is critical not only for sending donation receipts for tax deduction purposes but also for boosting retention rates by showing supporters that your organization values them.

To continue promoting transparency regarding your nonprofit’s use of funds, include examples of how you plan to use each donor’s gift in their recognition message. For instance, you could say something like, “Thank you, [donor name], for your generous contributions during our silent auction this past weekend. The funds you helped us raise bring our organization one step closer to launching our new community outreach program!”

Implementing ethical fundraising practices at your nonprofit has a variety of benefits, from avoiding legal penalties to improving financial management to strengthening donor relationships. Use the tips above to get started, and don’t hesitate to reach out to nonprofit compliance experts if you need help or have any questions.

Greg McRay, Foundation Group

Greg McRay, Foundation Group

Greg is the founder and CEO of Foundation Group, one of the nation's top providers of tax and compliance services to nonprofits. Greg and his team have worked with tens of thousands of nonprofits for over 25 years, assisting them with formation of new charities, plus tax, bookkeeping, and compliance services. He is credentialed as an Enrolled Agent, the highest designation of tax specialist recognized by the Internal Revenue Service. Based in Nashville, Tennessee, Greg and company work with charities and nonprofits all across the country and worldwide.

Greg McRay, Foundation Group